Are you looking for a credit card that rewards you for your everyday purchases? Look no further than the Capital One Quicksilver agreement. This credit card offers a multitude of benefits and perks that make it a must-have for anyone looking to maximize their spending. Let`s dive into the details and uncover why the Quicksilver agreement is a game-changer in the credit card industry.

The Capital One Quicksilver agreement is designed to make your life easier and more rewarding. Here some key benefits come with credit card:

| Unlimited Cash Back | With the Quicksilver agreement, you earn unlimited 1.5% cash back on every purchase, every day. Whether you`re buying groceries, filling up your gas tank, or treating yourself to a nice dinner, you`ll be earning cash back with every swipe of your card. |

|---|---|

| No Annual Fee | Many credit cards come with hefty annual fees, but not the Quicksilver agreement. You can enjoy all the benefits of this card without having to worry about an annual fee eating into your rewards. |

| Introductory APR | New cardholders can take advantage of a 0% introductory APR on purchases for the first 15 months. This is a great opportunity to make big-ticket purchases and pay them off over time without accruing interest. |

To truly make the most of the Quicksilver agreement, let`s take a look at a case study. Meet Sarah, a Quicksilver cardholder who loves to travel and dine out. By using her Quicksilver card for all her purchases, she was able to earn $500 in cash back rewards in just one year. With the ease of redeeming her rewards, Sarah was able to use her cash back to offset the cost of a weekend getaway, making her Quicksilver card an invaluable asset.

One of the standout features of the Quicksilver agreement is its flexibility. Whether you want to redeem your cash back as a statement credit, a check, or gift cards, the choice is yours. This level flexibility ensures use rewards way best suits lifestyle needs.

The Capital One Quicksilver agreement is a stellar choice for anyone looking to earn cash back on their everyday purchases. With its unlimited rewards, no annual fee, and introductory APR offer, there`s no denying the value of this credit card. If you`re ready to start maximizing your spending and reaping the benefits, the Quicksilver agreement is the way to go.

| Question | Answer |

|---|---|

| 1. What is the Capital One Quicksilver Agreement? | The Capital One Quicksilver Agreement is a legal document that outlines the terms and conditions of the Quicksilver credit card offered by Capital One. It details the rights and responsibilities of both the cardholder and the credit card issuer. |

| 2. What are the key terms and conditions of the Capital One Quicksilver Agreement? | The key terms and conditions include the annual percentage rate (APR), fees, payment due dates, credit limits, and rewards program details. It also covers the cardholder`s liability for unauthorized charges and dispute resolution procedures. |

| 3. Can the terms of the Capital One Quicksilver Agreement change? | Yes, the terms of the Capital One Quicksilver Agreement can change with proper notice to the cardholder. Capital One may update the APR, fees, or other terms, and the cardholder has the right to accept the changes or close the account. |

| 4. What I have dispute Capital One Quicksilver Agreement? | If you have a dispute with Capital One related to the Quicksilver Agreement, you should first attempt to resolve the issue directly with the credit card issuer. If the dispute remains unresolved, you may consider pursuing legal action or arbitration. |

| 5. Are there any hidden fees in the Capital One Quicksilver Agreement? | There are no hidden fees in the Capital One Quicksilver Agreement. All applicable fees, such as annual fees, late payment fees, and foreign transaction fees, are clearly disclosed in the agreement. |

| 6. Can I transfer my balance to a Capital One Quicksilver card? | Yes, you can transfer your balance to a Capital One Quicksilver card, subject to approval. The terms and conditions of balance transfers are outlined in the Quicksilver Agreement, including any applicable fees and promotional APRs. |

| 7. What happens if I miss a payment under the Capital One Quicksilver Agreement? | If you miss a payment under the Quicksilver Agreement, you may be charged a late payment fee and your APR may increase. It`s important to make timely payments to avoid negative consequences on your credit and account status. |

| 8. Can I use my Capital One Quicksilver card internationally? | Yes, you can use your Capital One Quicksilver card internationally. However, be aware of foreign transaction fees and currency conversion rates detailed in the Quicksilver Agreement. |

| 9. What are the benefits of the Capital One Quicksilver Agreement? | The Benefits of the Quicksilver Agreement may include cash back rewards, annual fees, fraud protection features. Review the agreement to understand the specific benefits available to cardholders. |

| 10. Is the Capital One Quicksilver Agreement governed by a specific state`s laws? | The Capital One Quicksilver Agreement may specify the governing law and jurisdiction for resolving disputes. It`s important to review the agreement to understand which state`s laws apply to the interpretation and enforcement of the contract. |

This Capital One Quicksilver Agreement (the “Agreement”) is entered into as of the Effective Date by and between Capital One and the Cardholder (collectively, the “Parties”). This Agreement sets forth the terms and conditions under which the Cardholder may use the Capital One Quicksilver credit card (the “Card”).

| 1. Definitions |

|---|

| 1.1 “Card” means the Capital One Quicksilver credit card issued to the Cardholder. |

| 1.2 “Cardholder” means the individual to whom the Card is issued. |

| 1.3 “Capital One” means Capital One Financial Corporation, the issuer of the Card. |

| 2. Card Use |

|---|

| 2.1 The Cardholder may use the Card to make purchases and obtain cash advances, subject to the terms and conditions of this Agreement. |

| 2.2 The Cardholder agrees to pay all charges and fees incurred using the Card in accordance with the terms of this Agreement. |

| 3. Billing Payments |

|---|

| 3.1 The Cardholder will receive a billing statement each month, listing all charges and fees incurred using the Card. |

| 3.2 The Cardholder agrees to pay the minimum payment due by the due date listed on the billing statement. Failure to pay the minimum payment by the due date may result in late fees and interest charges. |

| 4. Termination |

|---|

| 4.1 Capital One may terminate this Agreement at any time, for any reason, upon notice to the Cardholder. |

| 4.2 The Cardholder may terminate this Agreement by returning the Card to Capital One and paying any outstanding balance in full. |

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

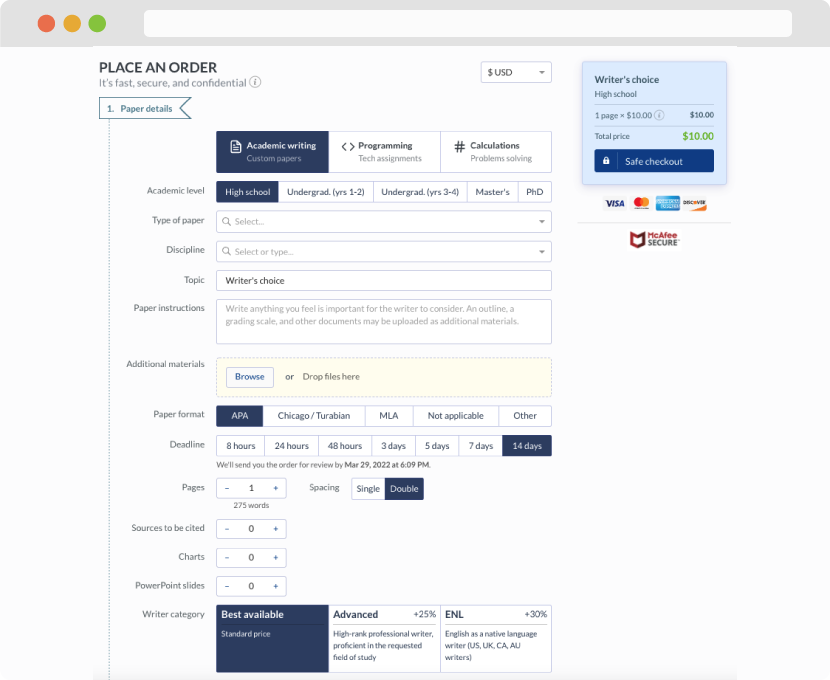

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

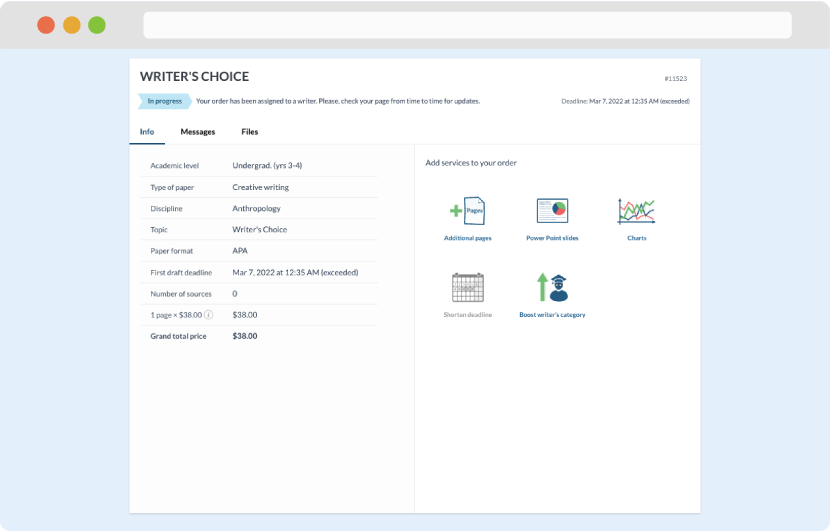

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

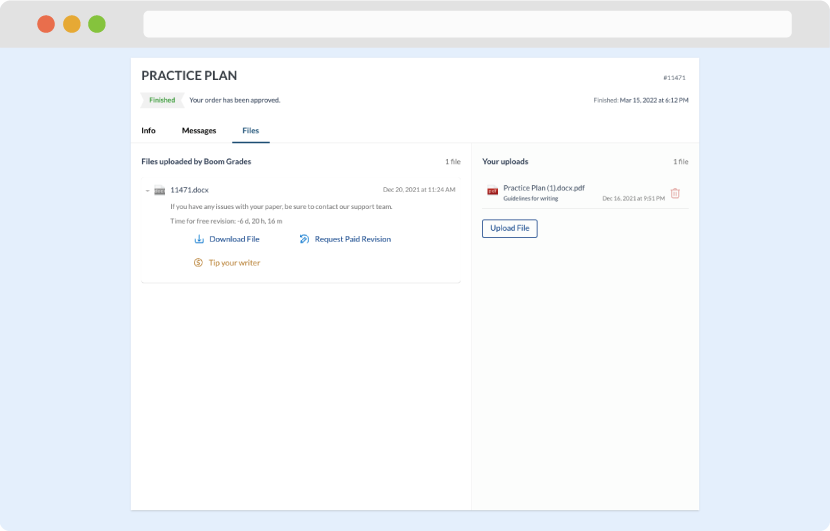

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download