| Question | Answer |

|---|---|

| 1. What is a co-lending agreement? | A co-lending agreement is a contract between two or more lenders who agree to jointly provide a loan to a borrower. It allows lenders to share the risk and reward of lending while defining their respective rights and responsibilities. |

| 2. What are the key elements of a co-lending agreement? | Key elements of a co-lending agreement include the loan amount, interest rates, repayment terms, default provisions, and the allocation of responsibilities between the co-lenders. |

| 3. How does a co-lending agreement differ from a traditional loan agreement? | Unlike a traditional loan agreement with a single lender, a co-lending agreement involves multiple lenders who must coordinate their actions and decisions. This requires careful drafting to address potential conflicts and ensure smooth operation. |

| 4. What considerations be in co-lending agreement? | Legal considerations in a co-lending agreement include ensuring compliance with usury laws, addressing potential conflicts of interest, and defining the process for resolving disputes between the co-lenders. |

| 5. Can co-lenders have different levels of involvement in the loan? | Yes, co-lenders can have varying levels of involvement, such as one lender providing the majority of the funds while another lender plays a more passive role. The agreement should clearly outline each lender`s rights and obligations. |

| 6. What if co-lender wants transfer interest loan? | The co-lending agreement should specify the process for transferring a co-lender`s interest, including obtaining consent from the other co-lenders and the borrower. This helps maintain the stability and integrity of the loan structure. |

| 7. How are profits and losses typically allocated among co-lenders? | Profit and loss allocation is typically based on each co-lender`s contribution to the loan, whether in terms of funds, services, or expertise. The agreement should detail the formula for calculating each co-lender`s share. |

| 8. What happens if the borrower defaults on the loan? | If the borrower defaults, the co-lenders must decide on a course of action to recover their investment. The agreement should outline the process for enforcing the loan and distributing any recovered funds among the co-lenders. |

| 9. Can a co-lending agreement be terminated early? | Yes, a co-lending agreement can include provisions for early termination, such as the unanimous consent of the co-lenders or certain events triggering dissolution. Early termination may have legal and financial implications that need to be addressed in the agreement. |

| 10. What are the potential legal risks of co-lending agreements? | Potential legal risks include challenges to the enforceability of the agreement, conflicts between co-lenders, and regulatory compliance issues. Careful drafting and thorough legal review are essential to mitigate these risks. |

When it comes to financing, co-lending agreements can be a game-changer. This type of agreement allows multiple lenders to join forces and provide a loan to a borrower. The Benefits of Co-Lending Agreements numerous, from spreading risk to accessing new markets. Let`s take a closer look at this powerful financing tool and explore its potential.

A co-lending agreement, also known as a syndicated loan, is a financial arrangement in which two or more lenders work together to provide funds to a borrower. This type of financing structure is commonly used in large-scale projects, such as infrastructure development, real estate ventures, and corporate acquisitions.

Co-lending agreements can take various forms, such as parallel loans, club deals, and syndicated loans. Each lender in the agreement has a specific portion of the loan, along with individual terms and conditions.

The power of co-lending agreements lies in their ability to leverage the strengths of multiple lenders. By working together, lenders can spread risk, access new markets, and increase their lending capacity. For borrowers, co-lending agreements offer the potential for larger loans, lower costs, and more favorable terms.

| Benefits | Explanation |

|---|---|

| Risk | Multiple lenders share the risk of the loan, reducing individual exposure. |

| New Markets | Lenders can enter new markets and industries by partnering with other lenders. |

| Lending Capacity | Co-lending agreements allow lenders to participate in larger loan transactions than they could on their own. |

| Benefits | Explanation |

|---|---|

| Larger Loans | Borrowers can access larger loan amounts through co-lending agreements. |

| Lower Costs | Competition among lenders can lead to lower financing costs for borrowers. |

| Favorable Terms | Borrowers may negotiate more favorable terms with a group of lenders compared to a single lender. |

Let`s take a look at a real-life example of the power of co-lending agreements. In 2019, a consortium of lenders, including several international banks, co-lent $2.5 billion to finance the construction of a new airport in a developing country. By working together, the lenders were able to mitigate the risk of the large-scale project and provide the necessary funding to make the airport a reality. The project not only benefited the borrower but also contributed to the economic development of the region.

Co-lending agreements are a powerful tool in the world of financing. By bringing together multiple lenders, these agreements offer benefits to both lenders and borrowers. As the demand for large-scale financing continues to grow, co-lending agreements will play an increasingly important role in meeting the needs of borrowers and expanding the reach of lenders. The potential of co-lending agreements is truly remarkable, and their impact on the world of finance cannot be overstated.

This Co-Lending Agreement (“Agreement”) is entered into on this [Date], by and between [Party A] and [Party B], collectively referred to as the “Parties”.

| 1. Definitions |

|---|

| 1.1 “Co-Lending” shall mean the joint provision of credit by the Parties to [Borrower]. |

| 1.2 “Borrower” shall mean the entity receiving the co-lending credit from the Parties. |

| 1.3 “Loan Agreement” shall mean the agreement entered into between the Parties and the Borrower outlining the terms and conditions of the co-lending arrangement. |

| 2. Co-Lending Arrangement |

|---|

| 2.1 The Parties agree to jointly provide credit to the Borrower in accordance with the terms and conditions set forth in the Loan Agreement. |

| 2.2 Each Party shall be responsible for their respective share of the co-lending credit, as agreed upon in the Loan Agreement. |

| 3. Governing Law |

|---|

| 3.1 This Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction]. |

| 3.2 Any disputes arising out of or in connection with this Agreement shall be resolved through arbitration in [City], in accordance with the rules of [Arbitration Institution]. |

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

| Party A: __________________________ | Party B: __________________________ |

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

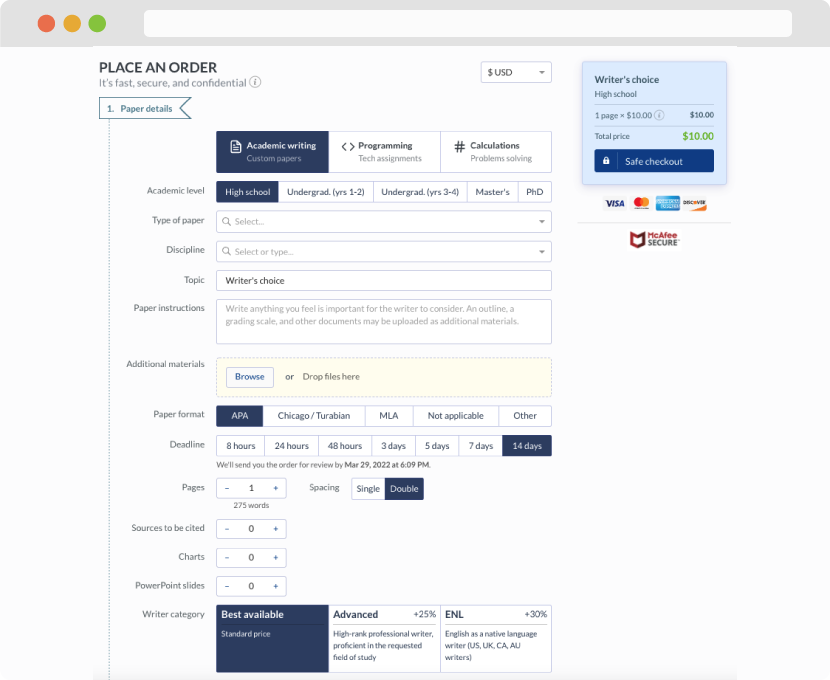

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

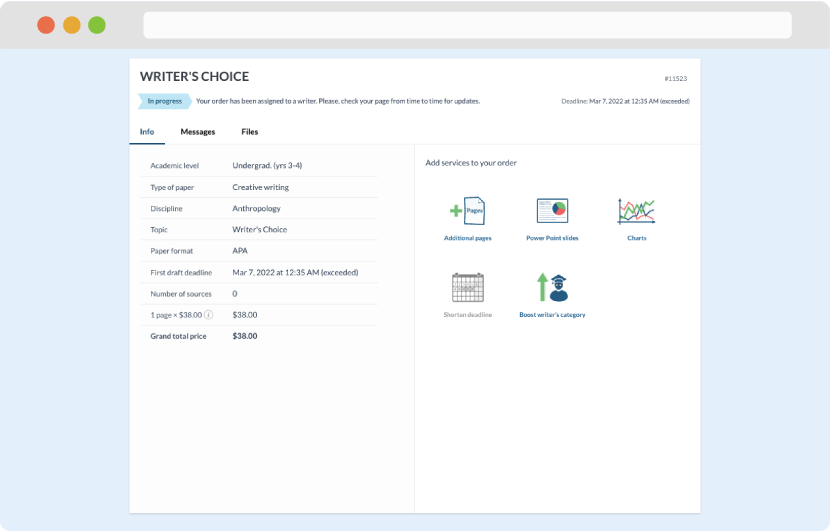

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

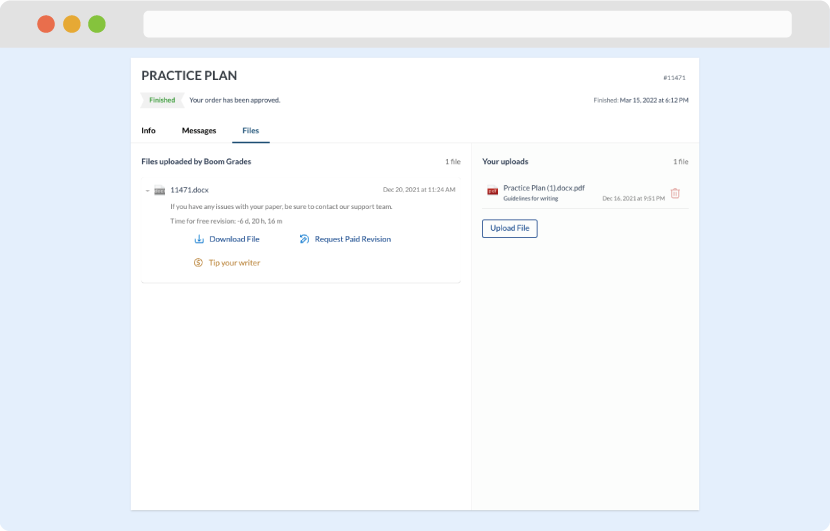

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download