Create a 5 page essay paper that discusses Tax Havens or Off Shore Financial Centre.

Download file to see previous pages…

Economic federations typically struggle with the impact and desirability of tax policy diversity among member states. In particular, there is widespread concern that low-tax areas within a federation impose a fiscal externality on other countries and might attract investment that would otherwise locate in high-tax areas within the same regions. There are no reliable estimates of the magnitude of such diversion. Moreover, there has been little consideration of the possibility that the availability of low-tax jurisdictions facilitates foreign investment and economic activity in high-tax jurisdictions within the same regions. The latter possibility arises if affiliates in low-tax areas offer valuable intermediate goods and services to affiliates in high tax areas, if the ability to relocate taxable profits into low-tax jurisdictions improves the desirability of investing in high-tax areas, or if low-tax jurisdictions facilitate deferral of home country taxation of income earned in higher-tax countries. High-tax countries might then benefit from tax diversity within regions, particularly if domestic governments would prefer to offer tax concessions to multi-jurisdictional businesses but are constrained not to do so by non-economic considerations.

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

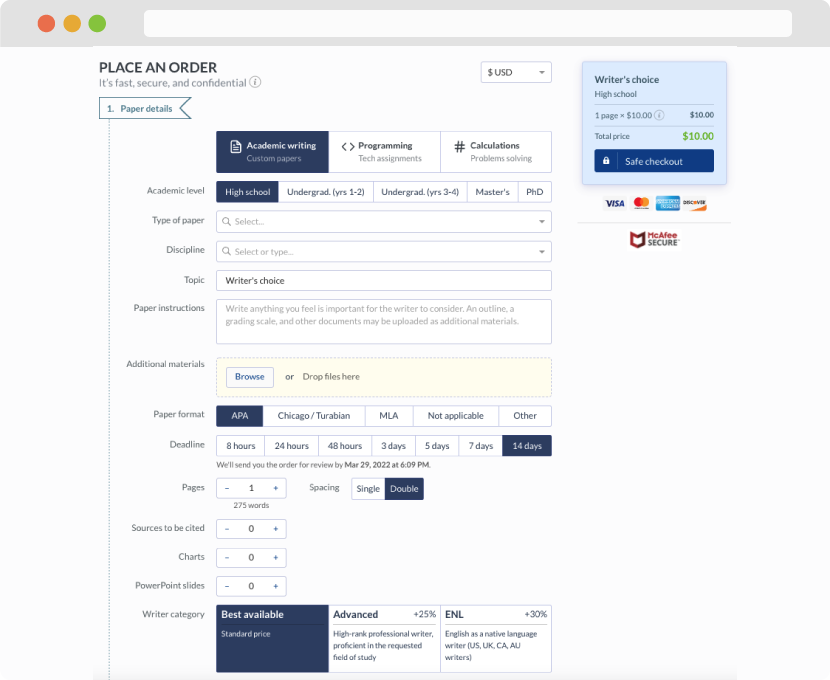

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

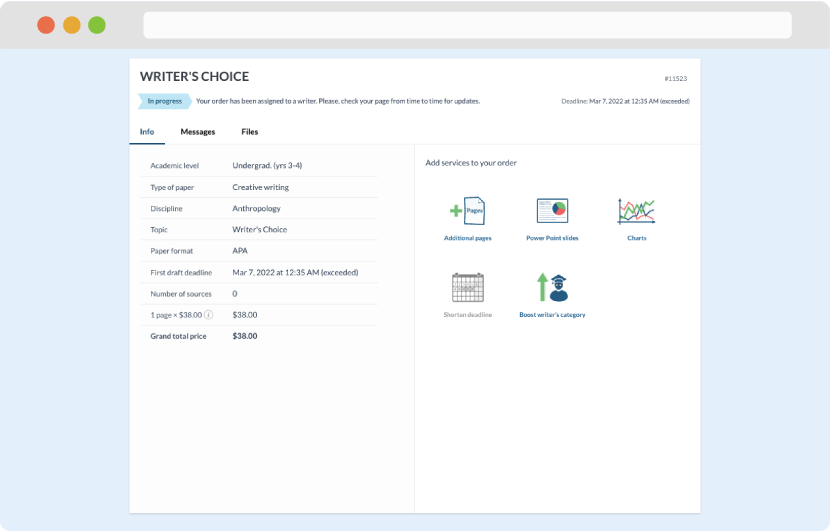

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

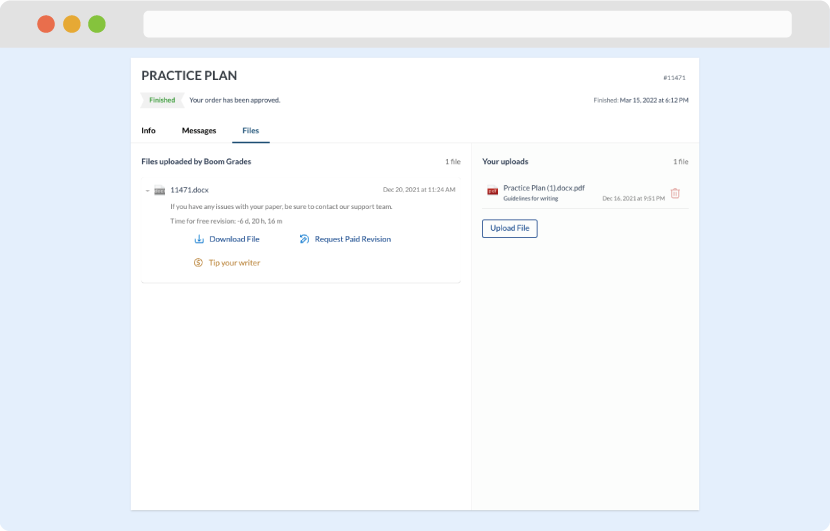

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download