Facts. A client has engaged you to advise her on how she is doing with her preparation for retirement. She is a well-paid professional with a current salary of $150,000. She has 15 years until her full retirement age and wants to be able to retire at that time. She expects that her salary will increase about 2% each year until retirement. Client has a taxable brokerage account that now generates about $3,500 in dividends each year. This dividend income can be expected to increase by 5% each year. Client is vested in a small pension from a previous employer that will pay about $15,000 per year during retirement. There is no cost of living adjustment (COLA) for this pension, so the $15,000 figure will not change during the retirement years. Regarding Social Security, Client’s earnings have always been at or above the maximum amount subject to Social Security withholding. In terms of retirement savings, 20% of Client’s annual salary goes into her retirement savings accounts (10% her money with an employer contribution of 10%). If she needs to increase her retirement savings, she has access to a tax-sheltered account into which up to an additional 10% of her salary can go.Use the following information as you develop your retirement plan for Client— o Rate of inflation for all years, 3.5% (use this as the COLA for adjusting Social Security benefits) o Expected rate of return on retirement savings o Until 5 years from retirement (i.e., next 10 years in the base case), 7.5% o Last 5 working years and all retirement years), 5% o Current retirement savings balance, $600,000 o Until retirement, Client puts her dividend income into savings (a rainy day fund). After retirement, the dividend income will go towards meeting her retirement income goal, but, barring an emergency, the principal will not be touched. Accordingly, only the dividend income from this “rainy day fund” should be considered in your analysis—although, you certainly can inform the client as to the value of the stocks in this fund at various points in time (assume stock value also increases 5% a year, which drives the increase in dividends) Answer each of the following questions. • At full retirement age, how much Social Security will Client qualify for (in future $’s)? Use the Quick Calculator benefits calculator at www.SSA.gov to make this determination. What is Client’s Social Security benefit if retirement is delayed until age 70? • Using the SSA.gov website, determine Client’s life expectancy, assuming she is 52 years of age right now and will retire in 15 years at the age of 67. Client’s DOB is February 1, 1961. • Recommend a target income that Client will need her retirement savings to provide—for now, just think about the first year of retirement. • Remember that Client has several sources of retirement income, other than her retirement savings—Social Security, dividend income, and $15,000 annual pension. The retirement income that her retirement savings must fund is her target income less these other sources of retirement income. • Client wants her retirement income to equal 90% of her pre-tax earnings in her last working year. She assumes that her current salary will grow at the inflation rate of 3.5% per year. Think carefully about this! She is saving a 10% of her salary for retirement and FICA is 7.65%. After retirement, she will no longer be saving for retirement and retirement income is not subject to FICA. So, when Client says “90% of her earnings,” she means earnings that she can spend (i.e., net of retirement savings and FICA). Social Security benefit at FRA of 67? Social Security benefit at age 70? Life expectancy given DOB 2/1/1961? What is Client’s target (total) retirement income in the first year of retirement (at age 67)?How much of the above retirement income must come from Client’s retirement savings?

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

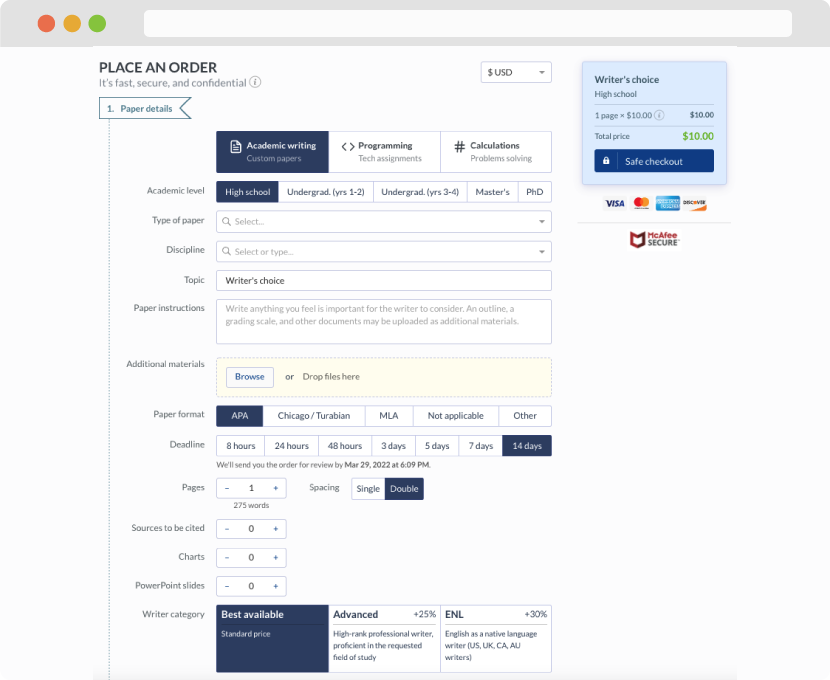

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

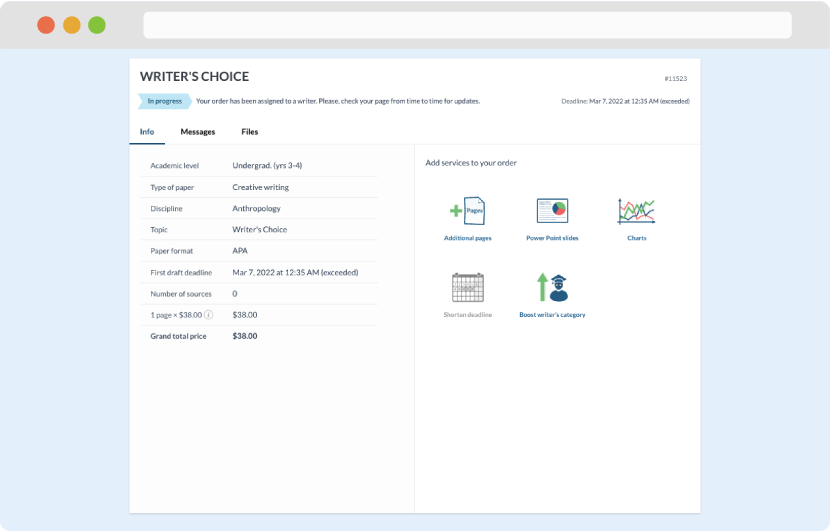

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

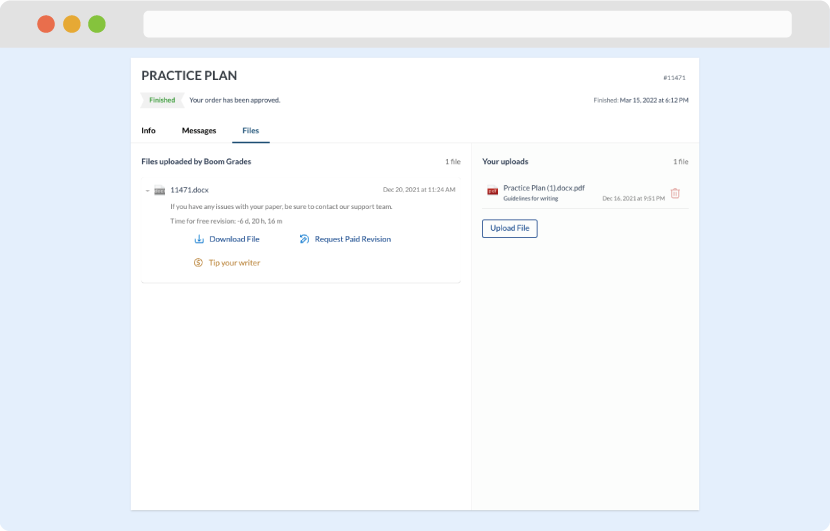

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download