As lawyer in tax law, topic gifting money spouse tax free one I particularly The being transfer to spouse incurring implications powerful for planning management. Delve the of often area tax law.

Under IRS individuals allowed gift up certain to person each without gift tax. Tax 2021, annual gift tax $15,000 recipient. Means give up $15,000 spouse having report gift pay gift tax.

| Year | Annual Gift Tax Exclusion |

|---|---|

| 2021 | $15,000 |

| 2020 | $15,000 |

| 2019 | $15,000 |

Married couples have the unique ability to “split” gifts, effectively doubling the annual gift tax exclusion for transfers to the same individual. Means married couple give up $30,000 spouse year incurring gift tax liability.

Understanding the Annual Gift Tax Exclusion ability split gifts powerful for planning wealth transfer. By leveraging gifting individuals couples transfer assets spouses beneficiaries incurring gift tax.

Max and Sarah, a married couple, have two children and want to start transferring assets to their kids as part of their estate planning. They decide to take advantage of the annual gift tax exclusion and gift $30,000 to each child every year. Over time, this strategy allows them to transfer a significant amount of wealth to their children without incurring gift tax.

The ability gift money spouse tax free valuable for planning transfer. By annual gift tax exclusion Gift Splitting for Married Couples, individuals strategically transfer assets spouses beneficiaries incurring gift tax liability.

This contract is entered into on this day [Insert Date], between [Insert Your Name], hereinafter referred to as the “Donor”, and [Insert Spouse`s Name], hereinafter referred to as the “Recipient”.

| Section 1: Purpose |

|---|

|

The purpose of this contract is to legally declare the intention of the Donor to gift a certain amount of money to the Recipient in compliance with tax laws and regulations relating to spousal gifts. |

| Section 2: Gift Money |

|

The Donor hereby agrees to gift the sum of [Insert Amount] to the Recipient as a tax-free gift, pursuant to applicable laws and regulations governing the tax implications of spousal gifts. |

| Section 3: Representations Warranties |

|

The Donor represents warrants legal right authority gift Recipient, gift complies relevant tax laws regulations. The Recipient represents warrants use gifted money accordance laws lawful purposes. |

| Section 4: Governing Law |

|

This contract shall be governed by and construed in accordance with the laws of [Insert State/Country], without regard to its conflict of law principles. |

| Section 5: Entire Agreement |

|

This contract constitutes the entire agreement between the Donor and the Recipient concerning the subject matter hereof and supersedes all prior and contemporaneous agreements and understandings. |

| Question | Answer |

|---|---|

| 1. Can I gift money to my spouse tax-free? | Absolutely! You gift money spouse worrying taxes. IRS unlimited tax-free gifts spouses, long they U.S. Citizens. |

| 2. Are any restrictions amount I gift spouse? | Nope, give much want incurring gift tax. It`s a great way to show your love and appreciation! |

| 3. Do I need report gifts IRS? | While you don`t have to report the gifts on your tax return, it`s a good idea to keep a record of them just in case. But rest assured, there`s no need to worry about tax implications. |

| 4. Can I gift money to my non-citizen spouse tax-free? | Unfortunately, the unlimited tax-free gift rule only applies to spouses who are U.S. Citizens. If your spouse is not a citizen, there may be gift tax implications to consider. |

| 5. Are there any specific rules or requirements for tax-free gifting to a same-sex spouse? | Not at all! The same tax-free gifting rules apply to same-sex spouses as they do to opposite-sex spouses. Love knows no bounds, and neither does the IRS in this case! |

| 6. What if my spouse and I file separate tax returns? | Even if you and your spouse file separate tax returns, you can still make tax-free gifts to each other. Just make sure to keep track of the gifts for your own records. |

| 7. Can I gift property or assets to my spouse tax-free? | Absolutely! You can gift not only money, but also property and assets to your spouse without worrying about gift tax. It`s a great way to share your wealth and build a life together. |

| 8. What if my spouse and I live in a community property state? | Living in a community property state doesn`t change the tax-free gifting rules between spouses. You can still give to your heart`s content without any tax consequences. Love conquers all, even the IRS! |

| 9. Are there any situations where tax-free gifting to a spouse would not apply? | In general, tax-free gifting spouse pretty and rule. However, spouse not U.S. citizen, or if you`re trying to use gifts to avoid other tax responsibilities, it`s always best to consult with a tax professional. |

| 10. How does tax-free gifting to a spouse fit into estate planning? | Gifts to your spouse can play a key role in estate planning, as they can help reduce the overall size of your taxable estate. It`s just one more way that tax-free gifting to your spouse can benefit your financial future. |

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

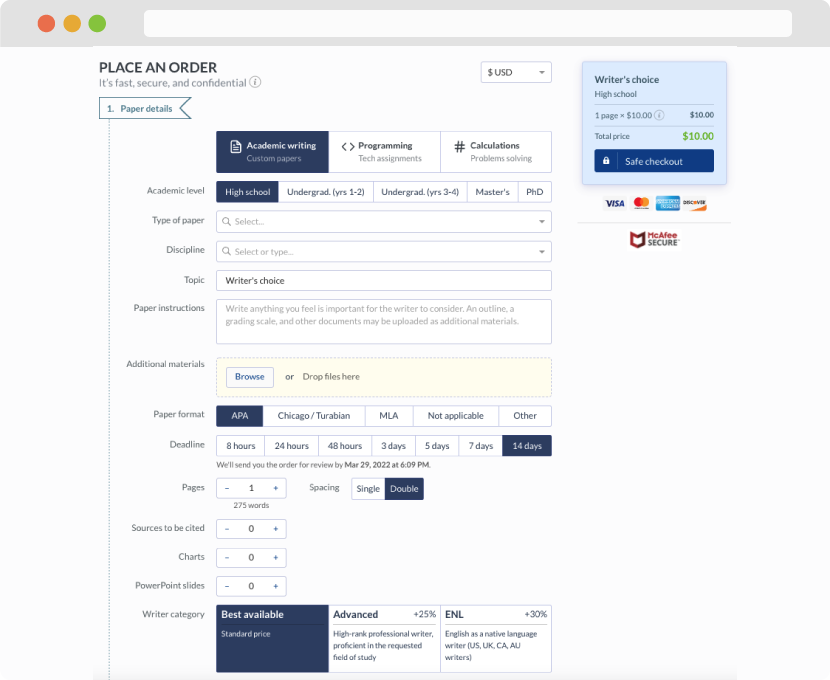

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

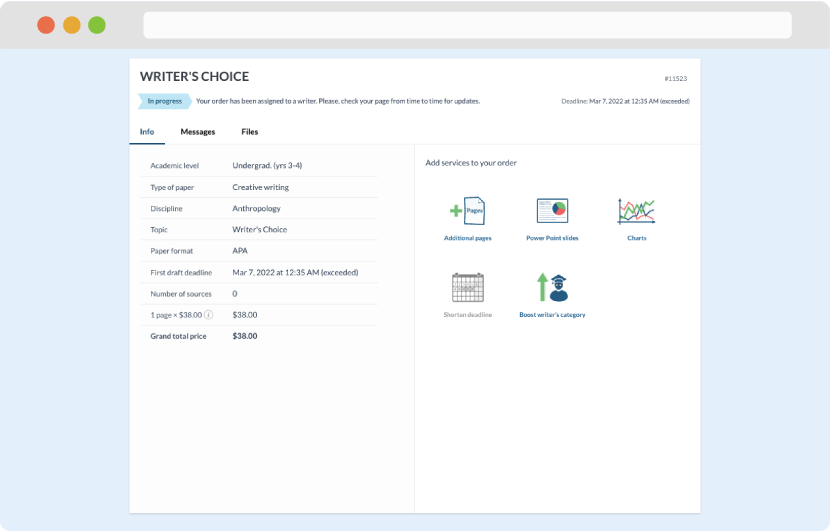

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

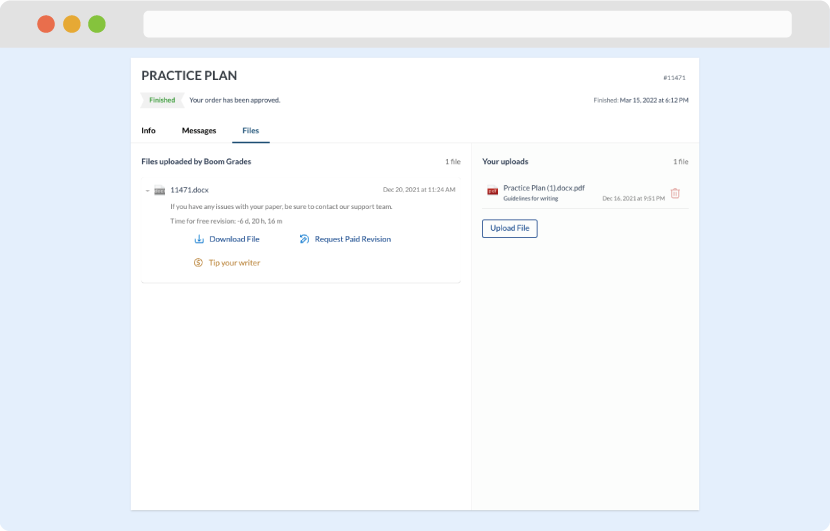

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download