Embarking on an initial public offering (IPO) can be a daunting but exhilarating process for any company. UK, specific requirements met successfully go public. Law enthusiast, delved complexities IPO requirements UK uncovered fascinating insights excited share.

Before a company can become publicly traded on the London Stock Exchange (LSE) or Alternative Investment Market (AIM), it must adhere to a set of stringent requirements. These requirements are designed to protect investors and ensure transparency in the financial markets.

The UK offers two main avenues for companies seeking to go public: the Main Market and AIM. The Main Market is the flagship market for larger, more established companies, while AIM caters to smaller, growing companies. The IPO requirements for each market differ, and companies must carefully consider which market best suits their needs.

Let`s take closer look key IPO requirements UK:

| Requirement | Main Market | AIM |

|---|---|---|

| Financial Track Record | Three years of audited financial statements | No specific track record required |

| Market Capitalization | Minimum £700,000 | No minimum requirement |

| Governance Standards | Must comply with UK Corporate Governance Code | Less stringent governance requirements |

To illustrate the impact of IPO requirements, let`s consider two hypothetical companies: Company A and Company B.

Company A, a well-established firm with a strong financial track record, opts for an IPO on the Main Market. The company diligently complies with the financial reporting and governance standards, successfully going public and attracting significant investor interest.

On the other hand, Company B, a smaller but innovative startup, chooses to list on AIM. With more flexible requirements, Company B is able to navigate the IPO process with relative ease, ultimately accessing the capital needed to fuel its growth.

As I wrap up my exploration of IPO requirements in the UK, I`m struck by the intricate balance between regulation and opportunity. The UK`s IPO requirements serve as a crucial framework for companies looking to take the leap into the public markets, and understanding these requirements is key to a successful IPO journey.

As of the effective date of this agreement, all parties involved are subject to the following terms and conditions pertaining to the Initial Public Offering (IPO) requirements in the United Kingdom.

| Clause 1: Definitions |

|---|

| In this agreement, “IPO” refers to the process of offering shares of a private corporation to the public in a new stock issuance. |

| Clause 2: Compliance Regulatory Requirements |

| All parties involved in the IPO process must adhere to the regulatory requirements set forth by the Financial Conduct Authority (FCA) and the London Stock Exchange (LSE) in the United Kingdom. |

| Clause 3: Appointment Legal Counsel |

| Prior to initiating the IPO process, the issuer must appoint a qualified legal counsel to ensure compliance with all applicable laws and regulations. |

| Clause 4: Disclosure Requirements |

| The issuer is required to provide full and accurate disclosure of all material information relating to the IPO, in accordance with the regulations set forth by the FCA and LSE. |

| Clause 5: Prospectus Approval |

| The issuer must obtain approval for the IPO prospectus from the FCA before making any public offerings of securities. |

| Clause 6: Offering Price Determination |

| The offering price of the shares must be determined in compliance with the relevant pricing guidelines and regulations established by the FCA and LSE. |

| Clause 7: Conclusion Agreement |

| This agreement shall come into effect upon the date of signing by all parties involved and shall remain in full force and effect until the completion of the IPO process. |

| Question | Answer |

|---|---|

| What minimum requirements company public UK? | Well, let me tell you, company must minimum £50,000 share capital appointed qualified advisor guide through process. It`s not a walk in the park, but it`s definitely doable. |

| What are the financial reporting requirements for a company planning to go public in the UK? | Oh, this one`s a little tricky. Company needs Three years of audited financial statements prospectus complies UK Listing Rules. It`s all about transparency and accountability, you know? |

| Are there any specific corporate governance requirements for companies seeking an IPO in the UK? | Absolutely! The company needs to have a clear corporate governance structure in place, including a board of directors with a proper balance of executive and non-executive members. It`s all about ensuring ethical behavior and responsible decision-making. |

| What regulatory requirements company needs comply IPO process UK? | Oh, there`s a whole list of regulatory requirements, my friend. The company needs to adhere to the UK Listing Rules, the Companies Act, and various regulations set forth by the Financial Conduct Authority. It`s a lot of paperwork, but it`s all in the name of investor protection. |

| Is specific timeline company needs follow preparing IPO UK? | Timing is everything in the world of IPOs. The company needs to carefully plan and execute the IPO process, which typically takes several months to complete. It`s a marathon, not a sprint, my friend. |

| What role does the London Stock Exchange play in the IPO process in the UK? | The London Stock Exchange is where the magic happens, my friend. It`s the primary market for IPOs in the UK, and the company needs to meet the listing requirements set forth by the LSE in order to go public. It`s like the gateway to the world of public trading. |

| Are there any specific industry-specific requirements for companies seeking an IPO in the UK? | Ah, the industry-specific requirements. It all depends on the nature of the company`s business. Certain industries, such as financial services and healthcare, may have additional regulatory requirements that need to be addressed. It`s all about tailoring the IPO process to fit the company`s unique needs. |

| What key considerations company deciding whether pursue IPO UK? | Deciding to go public is a big decision, my friend. The company needs to carefully consider factors such as market conditions, investor appetite, and the company`s long-term strategic goals. It`s a balancing act between risk and opportunity. |

| What are the ongoing compliance requirements for companies that have gone public in the UK? | Once the company goes public, the journey doesn`t end there. There are ongoing compliance requirements, such as financial reporting, disclosure obligations, and shareholder communication, that the company needs to maintain. It`s a commitment to transparency and accountability for the long haul. |

| What potential risks challenges company may face IPO process UK? | Oh, plenty risks challenges along road IPO. Market volatility, regulatory hurdles, and investor skepticism are just a few of the obstacles that the company may encounter. It`s faint heart, right guidance, can lead great rewards. |

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

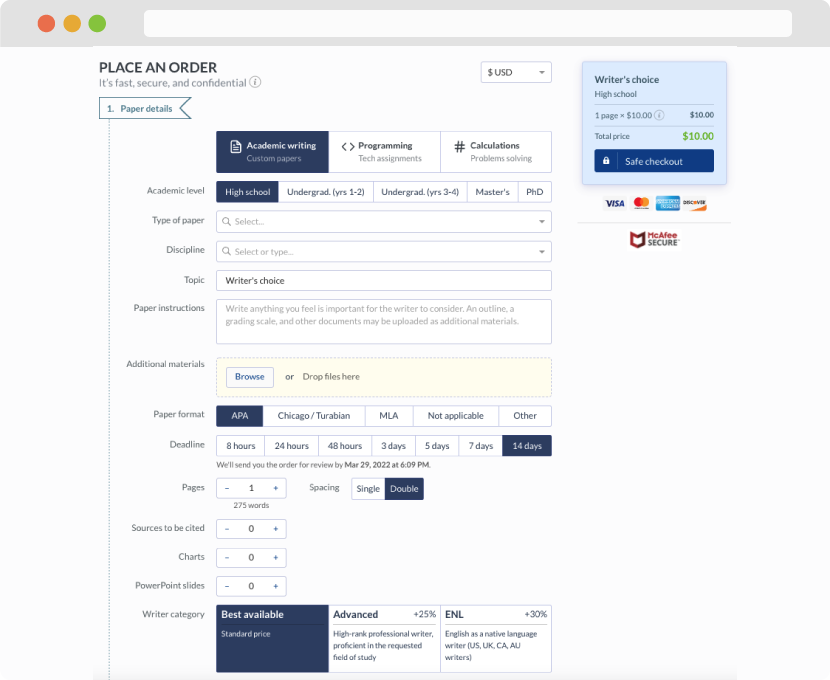

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

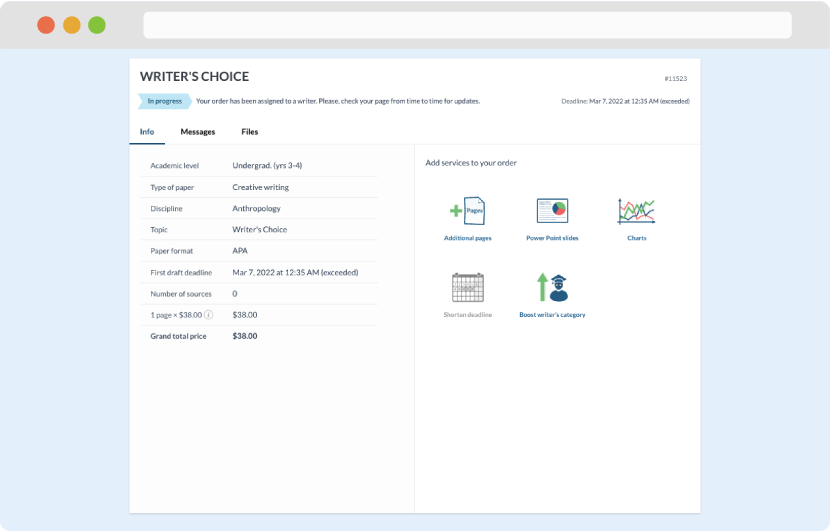

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

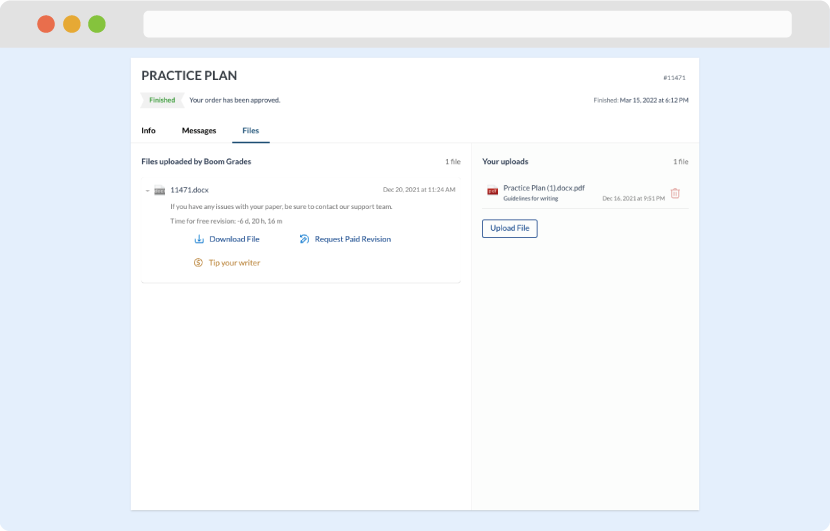

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download