As a legal professional, I`ve always been fascinated by the intricacies of employment law, particularly the common law test for determining whether a worker is an independent contractor or an employee. Workers crucial for both businesses individuals, determines legal rights obligations.

Before delving into the specifics of the common law test, it`s important to understand the distinction between independent contractors and employees. Independent contractors are individuals who are in business for themselves, providing services to clients or businesses. On hand, employees under direction control employer.

The common law test, also known as the “economic reality” test, is used by courts to determine whether a worker is an independent contractor or an employee. It involves assessing various factors that reflect the nature of the working relationship.

Here some key factors considered common law test:

| Factor | Description |

|---|---|

| Control | The degree of control that the employer exercises over the worker. |

| Opportunity for Profit or Loss | Whether the worker has the opportunity to make a profit or risk suffering a loss. |

| Investment in Facilities | Whether the worker has made investments in facilities, equipment, or tools. |

| Special Skills | Whether the worker`s skills are specialized and integral to the business. |

| Permanency of the Relationship | Whether the working relationship is ongoing or temporary. |

To provide further insight into the common law test, let`s examine a few case studies and relevant statistics:

In this case, the court ruled that delivery drivers for XYZ Delivery Services were misclassified as independent contractors, despite being required to wear company uniforms and follow specific delivery routes. The degree of control exerted by the company weighed heavily in the court`s decision.

Conversely, in this case, the court found that consultants at ABC Consulting Firm were properly classified as independent contractors due to their specialized skills and autonomy in managing their workload and clients.

According recent statistics U.S. Bureau of Labor Statistics, approximately 7% of the workforce is classified as independent contractors. This figure has been steadily increasing over the past decade, reflecting the growing trend of the gig economy and flexible work arrangements.

The common law test for determining independent contractor status is a complex and nuanced aspect of employment law. It requires a careful analysis of various factors to properly classify workers and ensure compliance with relevant labor laws. As the nature of work continues to evolve, it`s imperative for businesses and individuals to stay informed about the common law test and seek legal guidance when necessary.

This contract is entered into on this day [date] between [Company Name], hereinafter referred to as the “Company”, and [Contractor Name], hereinafter referred to as the “Contractor”.

| 1. Common Law Test |

|---|

| The Contractor acknowledges that in determining the status of the Contractor as an independent contractor, the Company will apply the common law test. This test includes factors such as the level of control exerted by the Company, the method of payment, and the provision of tools and equipment to the Contractor. |

| The Company reserves the right to assess the Contractor`s status and make determinations based on the common law test as per the prevailing laws and legal precedents. |

| 2. Independent Contractor Status |

|---|

| The Contractor acknowledges that the determination of independent contractor status is crucial for tax and legal purposes. The Contractor agrees to cooperate with the Company in providing information and documentation as required for such determination. |

| The Company will exercise its right to directly control or supervise the work performed by the Contractor in accordance with the common law test. |

| 3. Governing Law |

|---|

| This contract shall be governed by and construed in accordance with the laws of [State/Country]. Disputes arising contract subject exclusive jurisdiction courts [State/Country]. |

| Question | Answer |

|---|---|

| 1. What is the common law test for determining independent contractor status? | The common law test involves assessing the level of control a hiring party has over the worker. Factors such as the degree of autonomy, method of payment, and provision of tools and equipment are considered in this evaluation. |

| 2. How does the common law test differ from statutory tests? | The common law test focuses on the overall relationship between the worker and the hiring party, while statutory tests may have specific criteria outlined in statutes or regulations. |

| 3. Can a worker be classified as an independent contractor if they work exclusively for one company? | While working exclusively for one company may raise questions, it is not the sole determining factor. The totality of the working relationship and the level of control exerted by the hiring party are weighed in the common law test. |

| 4. Are there any specific guidelines for applying the common law test? | While there are no strict guidelines, courts often consider the nature of the work, the level of skill required, and the integration of the worker`s services into the hiring party`s business in making their determination. |

| 5. What role does the intention of the parties play in the common law test? | While intentions parties relevant, decisive. Courts will look beyond the written agreements and examine the actual working relationship to determine the worker`s status. |

| 6. Can a worker be classified as both an employee and an independent contractor for different purposes? | Yes, it is possible for a worker to be classified differently for different purposes, such as tax and labor law. The common law test may yield a different result compared to specific statutory tests. |

| 7. How does misclassification of independent contractors impact businesses? | Misclassification can lead to significant legal and financial consequences for businesses, including liability for unpaid wages, taxes, and benefits. It is essential for businesses to properly classify workers to avoid potential penalties. |

| 8. Can independent contractors still be entitled to certain benefits or protections? | While independent contractors may not receive the same benefits as employees, they may still be entitled to certain protections under labor laws, such as anti-discrimination and workplace safety regulations. |

| 9. Are there any recent developments in the application of the common law test for independent contractors? | The gig economy and remote work arrangements have prompted discussions about the modern application of the common law test. Courts are adapting to the evolving nature of work relationships in the digital age. |

| 10. What steps can businesses take to ensure proper classification of independent contractors? | Businesses should carefully evaluate the working relationships, seek legal guidance if uncertain, and ensure that their contracts and practices align with the factors considered in the common law test to minimize the risk of misclassification. |

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Writing Errands is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Essay Writing Service Works

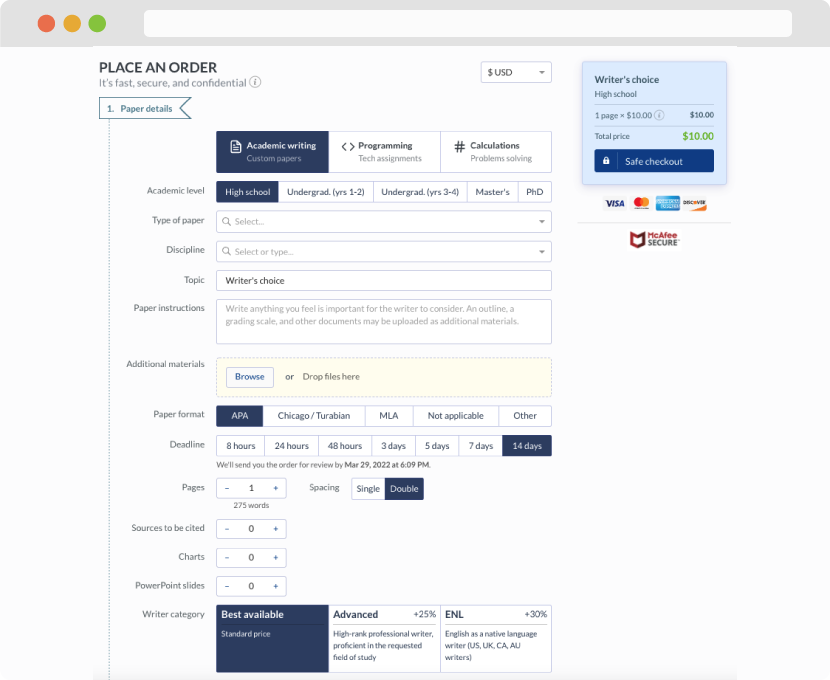

First, you will need to complete an order form. It's not difficult but, in case there is anything you find not to be clear, you may always call us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

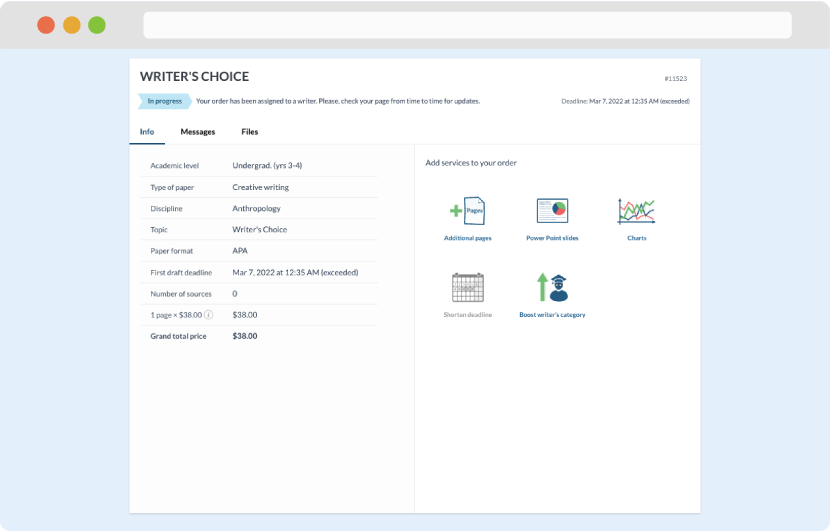

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

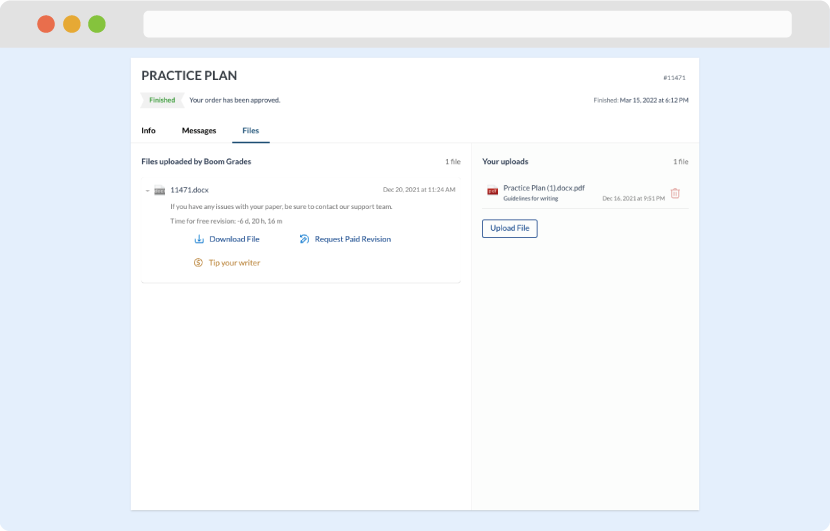

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download